Capital Allocation

The Art and Impact of Capital Allocation

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in the stocks mentioned and hence may be biased. This website and article aren’t written to give you advice. I am using it as my online journal to share knowledge and insights, and to gather feedback. I can’t guarantee the complete accuracy of all content, so please don’t rely on it. Please conduct your research or consult a professional financial advisor; I am not the one to provide this information.

As I prepare for the FY25 results of the companies I follow, I decided to document all the capital allocation decisions made by them, along with my thoughts on their implications in both the near and long term. While I was in the middle of that piece, I realised it had been a long time since I wrote anything for the fundamentals section of the site. When I first started writing publicly, I outlined my frameworks for researching companies, valuing them, and assessing risk. You can access them by clicking the links below.

While writing about capital allocation decisions of various companies, it struck me that I should first cover the core concept of capital allocation in my fundamentals section ( It is an important topic to have deliberate time allocated for clear thinking and documenting it). Once you hold a position, your job as an investor is to track whether the business is living up to your thesis. The easiest way to do that is by watching how the leadership team allocates capital.

My goal in writing this out isn’t to instruct or guide others. In reality, writing helps me clarify my thinking and internalise these concepts more deeply. Additionally, I don’t claim to be the one who originated these ideas. My views come from a mix of books, articles, podcasts, videos, and conversations with talented investors. Everything I write is an amalgamation of those influences, filtered through my understanding and whatever I can recall at the time of writing it.

What Is Capital Allocation?

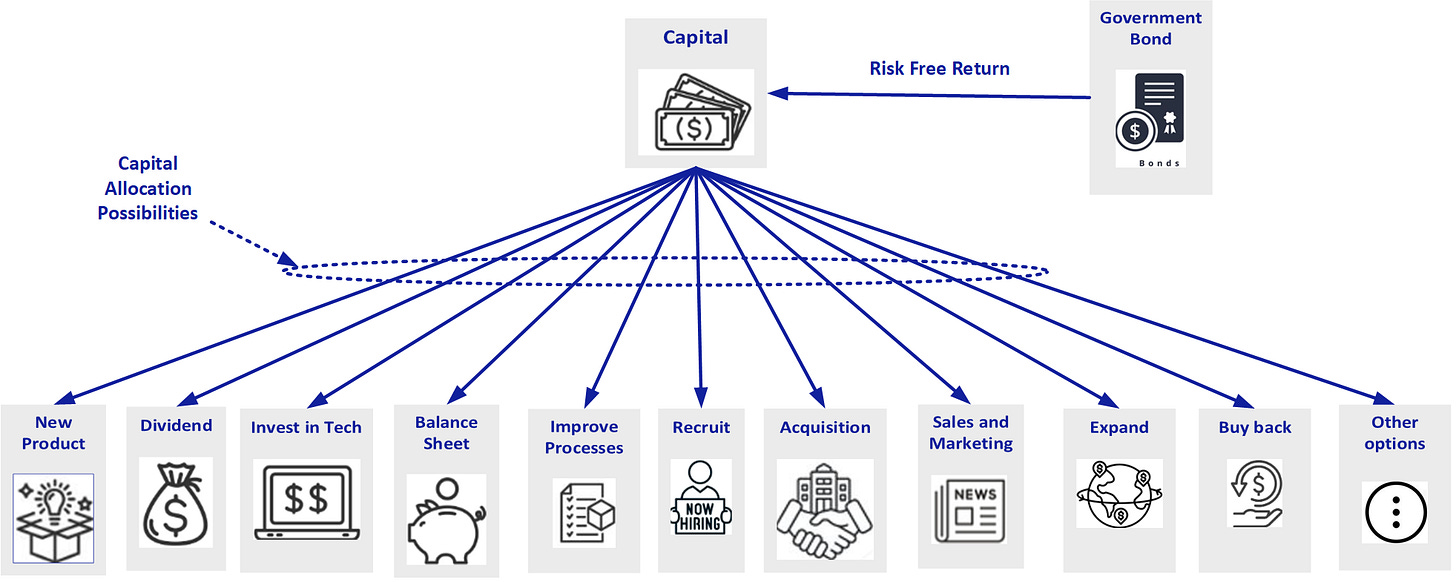

Capital allocation is simply how a company’s leaders decide to use the capital they have. This capital can come from different sources e.g., raising funds from investors, cashflow from the business, loans from banks, selling assets, or even advance payments from customers etc.

What really matters is how management chooses to spend it. Every choice, like launching a new product, buying another company, or giving cash back to shareholders or any other use, shows how well the leaders understand their business and what they believe will drive its future success.

Why does it matter?

When constructing an investment portfolio, we carefully consider the allocation of our investment in each position, either based on our conviction or risk appetite or near-term catalyst, special situation, etc. If larger holdings do well, they can drive strong returns, even if a few small positions don’t work out.

Businesses face a similar challenge. Businesses have a limited amount of capital and must decide how to allocate it across various growth opportunities. Think of each business initiative as a company’s version of a stock selection.

The way management chooses which idea to back reveals a lot about their capital allocation mindset as well as key underlying strategic thinking. Are they focused on quick wins or building for the long term? Do they spread their bets across many ideas or concentrate on just a few? These choices shape the company’s future and can make or break its success.

Capital allocation is critical for any business, but for small cap companies where every dollar counts, it's vital, and discipline is essential. For investors, understanding how a company allocates its capital isn’t just a theoretical exercise. It’s a key part of making smart investment decisions and avoiding costly mistakes. Making sure a company’s capital allocation actions are consistent with the story they are telling the market is essential.

The Cost of Capital: The Investor’s Benchmark

A fundamental principle in capital allocation is that any investment should generate a return greater than the cost of capital. For simplicity, let’s assume a cost of capital is 8%. If management invests in a project or acquisition, the expected return should comfortably exceed 8% per annum. ( If returns are less than 8%, it will be a value-destroying move)

There are several alternatives. If a Leadership team chooses to allocate capital somewhere, they are implicitly stating their conviction that this use of funds will outperform those alternatives. If they are not making this calculation, then it’s a red flag. Or even worse, if they don’t care.

Factors that matter most

Now that I have defined what capital allocation is and why it matters. The next thing is how to figure out leaders who allocate capital well. In other words, what attributes do you need to see to be comfortable that they will make good capital allocation decisions on your behalf? There are many factors, but these 5 are the main ones, as depicted in the picture below.

Incentive

Leaders who benefit when the company grows in value are more likely to make smart capital allocation decisions and avoid wasteful spending. Skin in the game is a good enough incentive, but also a remuneration structure that encourages responsible risk-taking and reward decisions that drive sustainable and long-term growth is something to look for.

Skill

Value-creating capital allocation needs a variety of skills. It starts with financial know-how and, deep understanding of the business itself. Just as important is building a culture that attracts, empowers, and incentivizes smart people. Broader skills at the board level as well as the executive level help them weigh opportunities from various perspectives and avoid common pitfalls in spending or investing the company’s money.

Vision

Leaders with vision allocate resources to areas that support long-term strategy, rather than just short-term gains. They direct capital to fuel innovations, expansion, and transformation that keep the business ahead in its industry. Leaders with vision see things that will be important for their customers in the future and make capital allocation decisions for them today.

Discipline

Leaders with financial and business discipline follow clear processes for evaluating opportunities and know when to say no. They avoid two traps:

Buying cheap assets that don’t fit

Overpaying for those that do fit

They stick with their strategy and avoid impulsive or emotion-driven decisions.

Accountable

It is also important to understand that throughout business life leadership team will make many decisions and not all of them will turn out to be good. In that instance, it is important to see how fast they acknowledge, pivot, and cut their losses.

Practical Steps for Investors

Capital allocation is not a one-time event. It’s an ongoing process that touches nearly every aspect of a business. Hence, once you have the business in your portfolio, you still need to keep an eye on all the decisions that management makes and filter it through a capital allocation lens to see if this business still fits in your portfolio or your money should be better allocated somewhere else.

Many public announcements (whether price-sensitive or not) can usually be traced back to capital allocation decisions. Each decision is a clue as to how management is thinking about the future and the bets they are making.

1. Read Between the Lines

Don’t just take company announcements at face value. Ask yourself:

What is the underlying capital allocation decision?

Does this move align with the company’s long-term strategy?

Is management chasing optics, or is real value being created? In other words, are they disciplined about returns?

One of the insights you can get from capital allocation is the time horizon that management adopts. Some investments, like new product development or geographic expansion, may take years to bear fruit. Others, like cost-cutting or minor acquisitions, might deliver quick wins.

Another insight comes from observing how management makes capital allocation decisions. Are they diversifying across multiple opportunities, or going all-in on a single big idea? Are decisions seem to be made based on careful analysis, or do they seem impulsive or for any other motive? In many ways, this mirrors the world of investing itself: the win ratio of bets, the size of each bet, and the overall risk profile all matter.

Aggressive Allocators: May pursue bold acquisitions or rapid expansion. This can lead to outsized returns, but also increases the risk of failure.

Conservative Allocators: Might focus on incremental improvements, maintaining a strong balance sheet, and returning capital to shareholders. This approach can be safer but may limit upside.

The best management teams strike a balance, making calculated bets with a clear understanding of the risks and rewards.

2. Track the Track Record

Look at the history of management’s decisions. Have past investments delivered the promised returns? Has the company created value over time, or have capital allocation missteps eroded shareholder wealth?

3. Assess Incentives

Review insider ownership and incentive structures. Are management and board members personally invested in the company’s success?

4. Compare Alternatives

Remember, every dollar spent is a dollar that could have been returned to shareholders or invested elsewhere. Is the chosen use of capital truly the best available option?

As you analyze potential investments, keep an eye out for companies that:

Consistently earn returns above their cost of capital

Communicate a clear, coherent capital allocation strategy

Demonstrate flexibility and learning from past decisions

In the end,

Capital allocation is the ultimate test of management’s skill and integrity. For small-cap investors, it is both a risk and an opportunity. By focusing on how leaders deploy the company’s resources, you gain a powerful lens for evaluating potential investments and avoiding costly mistakes.

The next time you review a company’s announcement or listen to a CEO’s presentation, ask yourself: What does this decision say about their approach to capital allocation? The answer may be the most important factor in your investment decision.

Investing in small cap companies is never without risk, but a keen understanding of capital allocation can help you separate the value creators from the pretenders.

Happy investing!

Practical framework for capital allocation analysis - particularly appreciate how you've structured the five key attributes for evaluating management's financial discipline. The working capital efficiency and return-on-capital focus aligns with trade credit optimization strategies that TCLM explores. You might find it useful.

(It’s free)- https://tradecredit.substack.com/