A S.O.L.I.D Framework (Quantitative Analysis)

Personal insights in evaluating the quality of a business

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in stocks mentioned and hence probably biased. This website and article isn’t writtent to give you advise. I am just using as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t relie on it. Please conduct your own research or consult a prefessinal financial advisor - I am not the one.

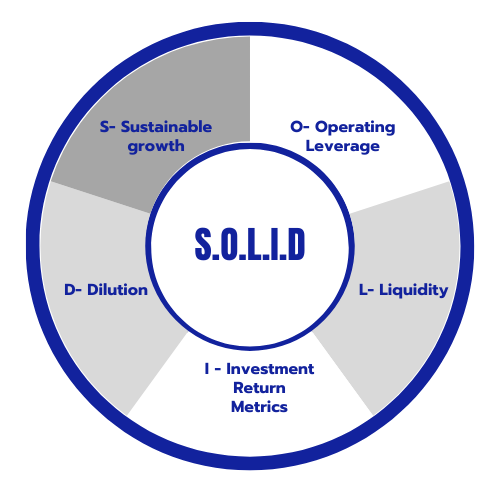

Last week, I explored the S.I.M.P.L.E framework to evaluate businesses through qualitative analysis. Today, Lets ponder over the S.O.L.I.D framework, which focuses on quantitative analysis. The primary goal is to assess the quality of a business as best as I can.

Once I am ok with or thought through all criteria within the S.I.M.P.L.E framework, I apply the S.O.L.I.D framework. As I mentioned in my first article, my methodology is always evolving. These frameworks are designed to be simple and memorable, and you're welcome to adapt them by adding your own criteria. For me, it's crucial to go through and think through whether a company passes both the S.I.M.P.L.E and S.O.L.I.D frameworks or not. Not all quality companies will satisfy all criterias, but the objective is to ensure thoughtful consideration and a solid rationale for any discrepancies. While the S.I.M.P.L.E framework helps judge the qualitative aspects, the S.O.L.I.D framework evaluates the quantitative elements, focusing on historical data. Although past performance doesn't guarantee future results, it provides a snapshot of the business's track record and helps assess its quality. This framework also helps in evaluating semi-annual and annual results to identify trends or changes in trends.

Let’s delve into the S.O.L.I.D framework:

S - Sustainable Growth (Revenue and Earning)

The long-term value of a business is largely determined by its revenue and profit growth. Consistency in growth, regardless of external and internal challenges, is the key. Growth expectations can vary depending on size and where in business cycle it fits ( for small company starting with relatively low base it is not too much to ask for to grow revenue more than 50% or even 100% YoY and mature company which is at more stable stage probably can satisfy with 5-10% YoY growth).

Revenue and Earning growth is straight forward to figure out based on all the data published. Within earning sometimes you may need to factor in few one-off and also monitor EBIT, EBITDA ( depending on you trust with managment - but all Adjusted and underling matrix - take it with pinch of salt)

O - Operating Leverage

Leverage means using something to gain a maximum advantage. For example, every Australian property investor uses financial leverage, i.e., borrows money to maximize their advantage.

Businesses have operations already set up, and gaining maximum advantage from these existing operations is called operating leverage. This means assessing how much sales the business can support before it needs to increase costs to accommodate new sales.

In other words, it involves scaling operations without equally increasing costs. For instance, my pizza company boosted its revenues by 15% last year while keeping the rise in operating expenses to a modest 5%. This scenario indicates not only growth but also effective resource utilization—like making and selling more pizzas without yet needing additional staff. (I will be tired as hell, but that’s a different topic.)

Operating leverage can also signify improvements in processes or gains in efficiency. Sometimes, it can be a sign of management's desperation, such as when staff is cut to unsustainable levels for short-term profit.

It's important to measure operating leverage and understand the reasons behind it and also figuring out if business is yet to capture total benifit of Operating leverage or its behind it.

L - Liquidity (and Balance Sheet Strength)

In personal life, your first task is to build an emergency fund worth six months of expenses so you can handle unexpected costs seamlessly and then make sure you have regular income which exceeds your expenses and that process will allow you to save a sufficient cash balance, enabling to aggressively seize long-term opportunities.

The same rules apply to businesses. Companies with ample cash or cash equivalents can cover not only short-term liabilities but also take strategic actions. Having more than enough cash allows businesses to invest in new product development, market expansion, hiring sales personnel, capitalizing on great talent availability, or pursuing compelling acquisition opportunities.

Businesses with a balance sheet showing "no debt" and sufficient cash are less likely to fail. Strength in the balance sheet provides significant downside protection—the second most crucial factor straight after management that avoids taking inappropriate risks.

Check Cash flow and Balance Sheet of business - Is it self sufficient ( i.e after removing all operating/investing and finance related expense it is actually making money) and has sufficient cash and no to low debt.

I - Investment Return Metrics

There are numerous metrics you can choose from to gauge the efficiency of a business based on the capital it utilizes.

ROE, or Return on Equity, measures a business's profitability with respect to its equity.

ROIC, or Return on Invested Capital, evaluates profitability as well, but it also includes debt financing in addition to equity.

I prefer ROE and ROIC as well as understanding their contexts thoroughly. This analysis will provide an ideal way to compare these metrics with those of other businesses in similar industries, offering insights into how well the business is performing relative to its peers. ( you can go little deep and calcluate Incremental Return on Invested Captial - ROIIC but i prefer to keep it simple)

D - Dilution (and Capital Management)

Effective capital management is essential for a business's long-term prosperity and the creation of shareholder value. Essentially, when a company increases its profits without issuing additional shares, each existing share gains a larger portion of the earnings, thereby boosting shareholder value. This highlights the importance of managing share counts wisely; even if a company is increasing its revenue and profits, issuing too many new shares can outpace earnings growth and dilute shareholder wealth. Such dilution can undermine the benefits of increasing revenues and profits on a per-share basis.

Capital management also showcases the strategic skills of a company's CEO and their ability to navigate various financial scenarios. Decisions on when and how to raise capital, buy back shares, secure loans, or pursue acquisitions—and the terms involved—serve as crucial indicators of the CEO’s ability to manage resources effectively. These decisions greatly influence the company's future. A track record of strong capital management indicates not only operational effectiveness but also strategic vision in boosting shareholder value.

Final thought

Investing is much like assembling a jigsaw puzzle; it requires piecing together multiple elements to grasp the complete picture. The S.I.M.P.L.E and S.O.L.I.D frameworks do precisely this, integrating key qualitative and quantitative criteria to provide a comprehensive view of a company's operational and financial health.

After evaluating a company using both frameworks and their associated criteria, the next step is to assess the business's valuation.

A high-quality company alone may not guarantee attractive returns. Understanding the company's true value is crucial (I'll explore how to assess business value without excessive complexity in future blogs).

What are your go-to criteria? Are the S.I.M.P.L.E and S.O.L.I.D frameworks sufficient, or am I overlooking something?

Thank you for reading. Now is the perfect time to reflect on these frameworks or to develop your own.