Xero (ASX:XRO) FY25 in review

Is new strategy playing out?

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in the stocks mentioned and hence probably biased. This website and article aren’t written to give you advice. I am just using it as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t rely on it. Please conduct your own research or consult a professional financial advisor - I am not the one.

Xero is one of the rare ASX-listed companies that seems to have pricing power. And pricing power doesn’t usually come without some kind of moat. In Xero’s case, that could be a mix of strong brand recognition, scale, the difficulty of switching platforms once you're in, and maybe even a bit of a flywheel effect from its growing ecosystem.

Over the past few years, Xero has moved away from a “growth at all costs” mindset. There’s been a clear shift toward what I call efficient growth, with less focus on chasing questionable acquisitions and spending huge marketing and sales $ in the region where they are facing their biggest competition. Instead, the New CEO hasn’t done any silly acquisitions and wound down a few businesses that were not fitting the strategy, and migrated towards focused growth in the US region and making its product appropriate for the US market before allocating a huge budget for growth.

When I last wrote about Xero here and here, I mentioned a few areas I’d be watching closely between FY25 and FY27. These were based on what the current CEO had outlined as part of her strategic vision after taking over the reins. Now that she’s been in the role for a couple of years and the FY25 results are out, I thought it’d be worth revisiting those ideas to see how things are tracking.

Here are three things that I believe are important for judging CEO performance.

Cost control

Revenue mix

Subscriber growth

1. Cost Control – Is the business becoming more efficient as promised?

One of the first things I look at when reviewing Xero is its operating income. With gross margins around 89%, the business has a lot of flexibility, but what matters is how well it manages the money below that line.

Here’s how FY25 operating expenses stacked up:

Sales & Marketing (S&M): 31.6% of revenue

Product Development (PD): 29.4%

General & Administrative (G&A): 10.8%

Add those up, and 71.8% of revenue is spent on operating costs, leaving about 17.2% for operating income. That’s quite a lift from around 6% a couple of years ago.

The CEO’s focus on streamlining costs is showing up in the numbers. So this is definitely a green tick for the CEO.

2. Revenue Mix – Is ARPU growing beyond just price hikes?

One of the themes in Xero’s strategy has been to build around three “jobs to be done” (JTBD): accounting, payments, and payroll. At the moment, most revenue still comes from accounting, but ideally, over time, the other two areas could play a bigger role.

Payments revenue grew 65% year-on-year, which is a good signal. There are also changes underway to improve payroll adoption, including adjustments to plans. That said, Xero doesn’t break out revenue by segment, so it’s hard to gauge how much progress is being made here.

It is too early to see the diversification of revenue between Accounting, Payments, and Payroll, just because Accounting is such a huge portion of the current revenue. This is what will become more evident as we progress towards FY27 and beyond.

While price increases have driven a good portion of revenue growth in recent years, hopefully, we will see Payments and Payroll do the heavy lifting in the coming years. This is probably an amber tick - I can see the sign of improvements but can’t be sure.

3. Subscriber Growth – UK/US Starting to Show Life?

Xero’s geographic focus continues to be on its three major markets: ANZ, UK, and US. They call this the “Win 3x3” approach—matching three regions with the three jobs to be done.

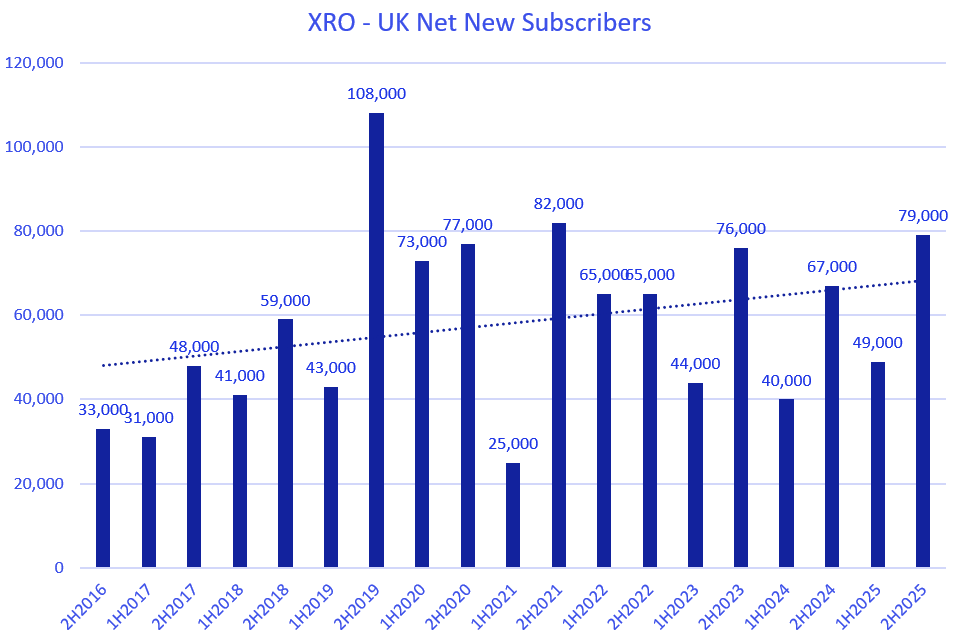

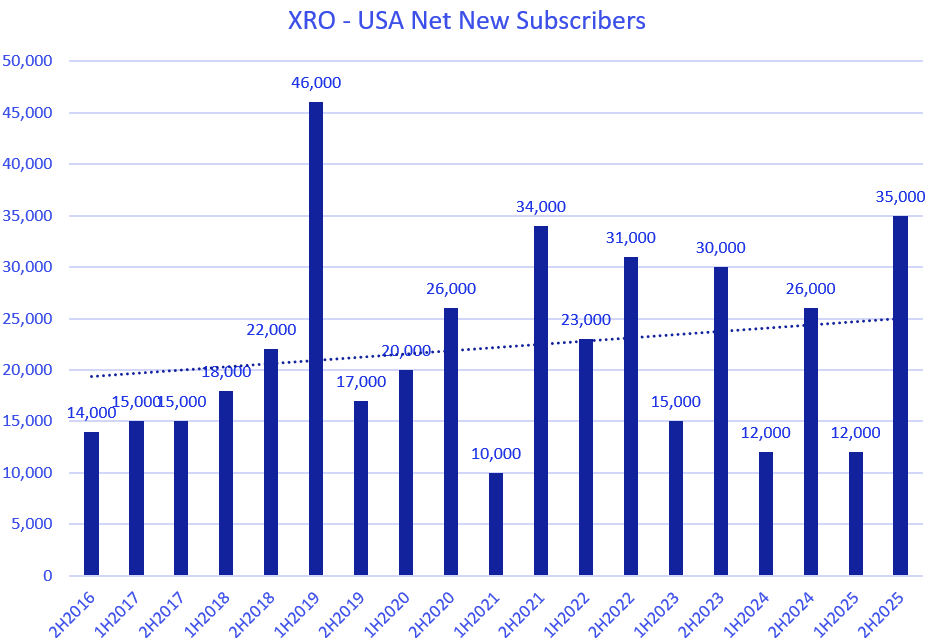

Here are the graphs showing the trend of net new subscribers in three major markets.

Looking at these graphs, I can see the UK and US saw an uptick in net new subscribers in the second half. It’s early, and one-half doesn’t make a trend, but it’s good to see some momentum there. These are much larger markets with much room to grow, if Xero can keep improving its product-market fit.

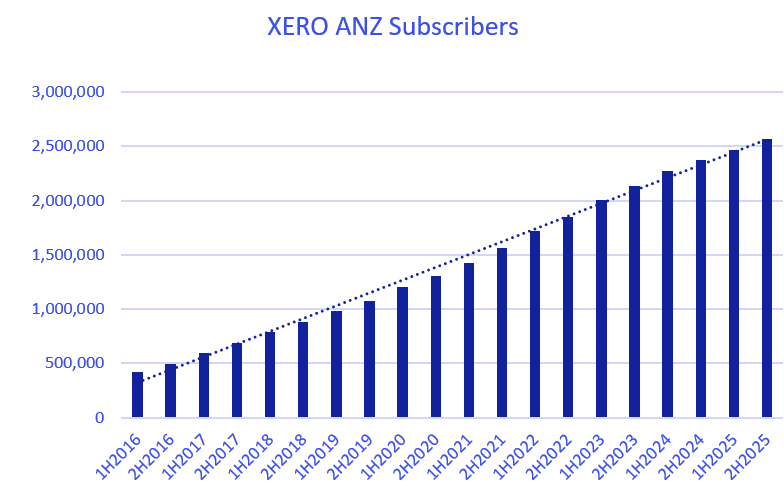

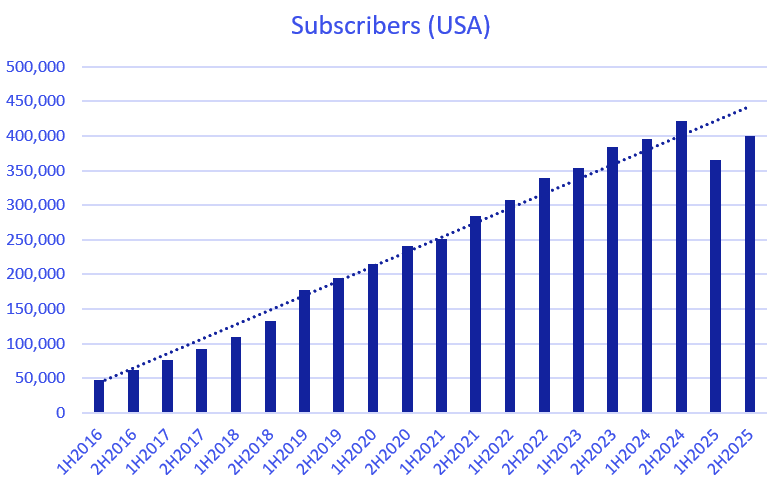

On the flip side, subscriber growth in ANZ has slowed. That’s probably not surprising given Xero’s strong market share in the region. Price increases seem to be doing more of the heavy lifting for growing revenue now. Either growth here has naturally plateaued, or price sensitivity is starting to impact new customer additions.

It’s hard to say for sure, but I do wonder whether Xero might need to ease off pricing in ANZ at some point to reignite customer growth—or maybe the next leg of growth really will have to come from outside Australia and New Zealand.

Overall, I think Xero’s FY25 results show some steady progress against the broader strategy laid out a couple of years ago. There’s a clear improvement in operating leverage, some signs of revenue diversification, and at least a glimmer of growth in the UK and US. Slow down in subscriber growth in the ANZ region is -ve. I think management has gone a bit too far with the price increase, which is impacting new customer additions.

With these thoughts in mind, giving the CEO strategy execution a green tick - Let’s analyse Financial performance for FY25

Revenue

The chart below shows Xero’s revenue trend, and it is very difficult to fault the growth it has achieved. For FY25, it has reported revenue of $2.1B i.e, 20% growth in constant currency compared to FY24.

Subscribers ( Xero’s customers)

The charts below show how Xero has grown its customer base over the years - Xero calls its customers subscribers. The first graph shows overall subscribers, and the subsequent graph shows subscriber growth performance in the ANZ, UK, and USA regions.

Note: The dip in 1H2025 in the USA and UK charts is because Xero decided to remove its roughly 160K long idle subscribers from the count ( those subscribers were mainly in USA, UK, and Rest of the World region)

Average Revenue Per User (ARPU)

While price increases have been the main driver of ARPU growth, other factors like cleaning up long-idle subscriptions, growth in payments revenue, and foreign exchange movements have also played a role.

NPAT

There’s no better chart to highlight Xero’s shift in focus toward profitability starting in the second half of 2023, when the company trimmed its workforce to the right size and wrote down some of the questionable acquisitions made before the current CEO came on board..

Valuation

Xero currently has around 154 million shares on issue. At a share price of $180, that gives it a market cap of roughly $28 billion. [ Edit: I forgot to convert AUD to NZD during my initial article - So that is roughly $30.4 billion NZ$ ]

For FY25, Xero reported revenue of $2.1 billion, EBITDA of $638.5 million, and a net profit after tax (NPAT) of around $228 million.

That means it's trading at about 13.4 (14.47 - when converted to NZ$ ) times sales, an EV/EBITDA ratio of 43 (47 - when converted to NZ$), and a P/E of roughly 123 (133 - when converted to NZ$). This kind of valuation suggests the market is expecting strong future revenue growth and improved operating leverage over time.

If I run a reverse DCF and aim for a 10% annual return, Xero would need to grow its free cash flow by 30% (31% when converted to NZ$) per year for the next 10 years to justify the current price. Can it grow FCF at that pace for 10 years?

Alternatively, if you’re okay with a 6% annual return, then Xero needs to grow free cash flow at about 14% (14.5%, when converted to NZ$) annually for the next 10 years to justify the current price.

These aren’t my forecasts or assumptions—they just reflect what the market appears to be pricing in today. My reverse DCF assumes 10 years of growth before transitioning to a terminal growth rate. Of course, some quality businesses manage to grow meaningfully for much longer than that. Is Xero one of them? If I sell now, will I get the chance to buy back in before it grows into an even bigger beast? It rarely trades at a low valuation, and when it does, it usually means there’s something seriously wrong in the broader market.

I don’t have the answers, but these are the kinds of questions I find myself asking when I think about XRO’s place in my portfolio.

Like the way you are thinking about valuation for this stock.

Great article mate, very thoughtful