XERO's (ASX:XRO) Pivot to Profitability: A Focused U.S. Strategy Amidst Management Changes

XERO's Path to Sustained Earnings in the Competitive American Market

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in stocks mentioned and hence probably biased. This website and article isn’t writtent to give you advise. I am just using as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t relie on it. Please conduct your own research or consult a prefessinal financial advisor - I am not the one.

Introduction

Xero was founded by Rod Drury and Hamish Edwards in 2006, to bring cloud accounting tools to small businesses globally. The launch of Xero meant accountants and bookkeepers could collaborate with their small business clients in real-time through its open platform to monitor their financials, simplify core compliance and run their businesses.

Quickly resonating with its audience, Xero went public on the NZX Main Board by 2007 and Xero rapidly expanded its footprint beyond its Wellington headquarters, establishing operations across major cities including Auckland, Melbourne, Canberra, Sydney, Brisbane, San Francisco, and Milton Keynes. This global expansion underscored Xero's position as a fast-growing entity within the software industry. With a strong partner and customer base in Australia, Xero sought to streamline access for Australian investors, partners, and customers by a secondary listing on the ASX in 2012.

At its ASX debut in 2012, Xero had about 108 million shares and 112,000 subscribers. By September 2023, the share count rose to roughly 152 million, alongside a surge to 3.74 million subscribers. This reflects an annual growth rate of around 3% for shares and 34% for subscribers over the twelve-year period.

The interesting CAGR number for revenue is approximately 45% per year from around 24m in 2012 to 1.4b in 2023. This number underscores Xero’s successful expansion and increased market penetration over the years.

Xero has grown its offerings by innovating from within and by acquiring complementary businesses. Now, beyond its fundamental accounting software, Xero provides a variety of services, including payroll, workforce management, expense tracking, and project management, tailored to the specific needs of different regions. The platform boasts a robust network of integrated applications and financial partnerships, which equip small businesses with a versatile array of tools to manage their finances efficiently.

Market Opportunity

Xero is serving essential business functions such as accounting, payroll, and payment services needed by virtually every company worldwide. Xero's potential customer base is practically limitless. After all, every business needs accounting, payroll, and payment solutions. However, for strategic growth, Xero focuses on specific markets and business segments.

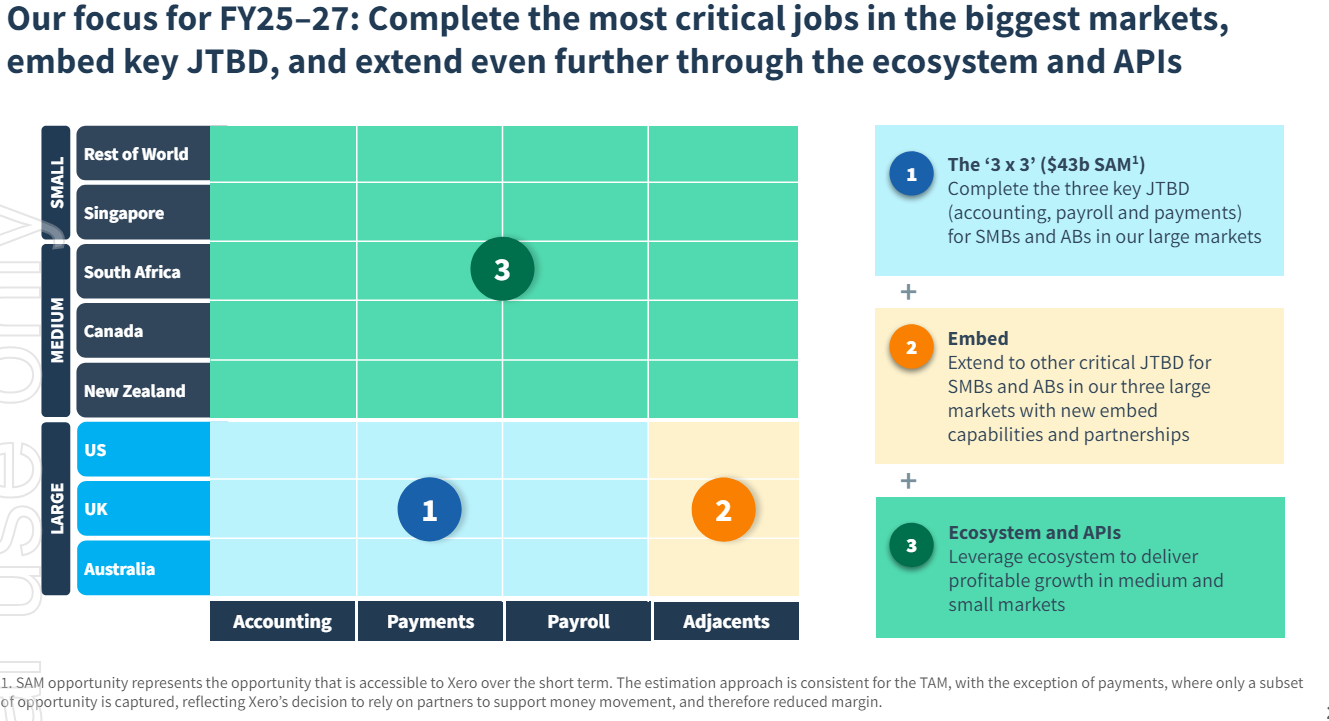

Geography: Xero prioritizes Australia, the United Kingdom, and the United States for their large number of small and medium-sized businesses (SMBs). It also strategically enters secondary markets like New Zealand, Canada, and South Africa, partnering with local providers for expansion.

Business Type: Xero targets the unique needs of self-employed individuals, micro-businesses (1-5 employees), and small businesses (6-20 employees).

Key Services: Within these markets, Xero primarily focuses on accounting, payroll, and payment solutions. Additional offerings like project management, expenses, and CRM provide further value to their customers.

Xero has unveiled its strategic roadmap for next few years, outlining its plan to capture a larger share of the global market for small and medium businesses (SMBs) and accounting/Bookkeeping businesses (ABs).

Xero defines this strategy as The “3 x3” which primarily focuses on nailing the fundamental trio of services: accounting, payroll, and payments, particularly for SMBs and ABs practices within the large market sectors of Australia, the UK, and the US, which collectively present a $43 billion Serviceable Available Market (SAM).

Management

Founder Rod Drury, whose vision initiated Xero's journey. He transitioned from his CEO role in March 2018, sold a portion of his shares in November 2017 for $95 million, reducing his holding to 13% but reaffirming his commitment to the company's long-term vision through his continued role as a non-executive director.

Steve Vamos, who took the helm as CEO of Xero in 2018, led significant operations for major players like Microsoft, Apple, and IBM in Australia and New Zealand. Under Vamos’s leadership, Xero embarked on an aggressive acquisition strategy to bolster its market offering and presence, a move that aligned with the market's then-appetite for growth and expansion over immediate profitability.

However, as the business climate shifted towards a stronger focus on financial sustainability and shareholder returns, the timing was ripe for a change in leadership. Enter Sukhinder Singh Cassidy.

Sukhinder Singh Cassidy, with her rich background at companies like Google and StubHub, is well-poised to lead Xero's charge. Supporting her vision is CFO Kirsty Godfrey-Billy, whose been long standing CFO and manages Xero’s financial strategies with acumen. Cassidy’s appointment as CEO marks a strategic pivot for Xero, aiming to align the company's operations with the current market demand for profitability — a move that is anticipated to generate long-term value for Xero and its shareholders

Recent strategic appointments have injected fresh perspectives into the executive team. Ashley Hansen joins as Chief Revenue Officer, bringing insights from Square and JP Morgan to drive sales and customer growth strategies. Diya Jolly's role as Chief Product and Technology Officer, enriched by her tenure at Okta and Google, is instrumental in advancing Xero's product development. Meanwhile, Michael Strickman steps in as Chief Marketing Officer, leveraging his experience from Uber and Tripadvisor to elevate the brand's global presence.

The collective experience of Xero’s management from successful global companies signals a bright future for Xero, as they leverage their combined industry intelligence to enhance and expand the company's services.

As of 31 March 2023, the equity holdings among Xero's directors, CEO, and CFO demonstrate a vested interest in the company's success. Founder Rod Drury remains a significant shareholder with 9,914,789 ordinary shares, underscoring his lasting commitment to the company. Non-executive director David Thodey holds 10,000 shares.

While Cassidy does not hold ordinary shares, her investment in the company is reflected in the significant number of unlisted options and restricted stock units (RSUs) amounting to 445,697 and 46,752, respectively. Godfrey-Billy holds 10,202 ordinary shares, with additional interests through 29,761 options and 12,127 RSUs.

Sukhinder Singh Cassidy's compensation as CEO of Xero is as follow.

A Total Fixed Remuneration of USD $700,000 per annum

A Long Term Incentive (LTI) program with a maximum opportunity of USD $2.5 million for FY23 and USD $5 million for FY24, granted as Restricted Stock Units (RSUs) . This LTI is subject to Cassidy meeting set performance criteria over a three-year performance period, Performance measures are

Compound Annual Revenue Growth (75%)

Relative Total Shareholder Return (25%)

Balance Sheet

Presently, the company's balance sheet shows that it has a net cash position, indicating that it has more cash and liquid assets than debts, highlighting a strong financial standing

Xero's convertible notes are set to mature on December 2, 2025. These financial instruments offer holders the option to convert their debt into a specified number of Xero shares if they so choose. Xero timed the issuance of these notes opportunistically, with the conversion price set at $134.7246 per share. Given this determined price, concerns about dilution of existing shares or stress on Xero’s balance sheet — should it opt for repayment in cash — are minimal. With Xero exhibiting positive free cash flow, there is a strong expectation that the company will continue to generate substantial cash going forward, providing flexibility in how it addresses these convertible notes upon maturity.

Financial Performance

Xero's financial performance has been remarkable, demonstrating significant revenue growth as illustrated in the accompanying graph. This upward trajectory in revenue is a testament to the increasing adoption of Xero's products by small and medium-sized businesses, as clearly indicated by the rising number of subscribers over the years.

In addition to growing its customer base, Xero has successfully increased its average revenue per user (ARPU). While the increase in ARPU has been moderate compared to subscriber growth, it's important to note that ARPU is influenced by various factors, including pricing adjustments, subscribers upgrading to premium plans, and the introduction of additional products or services. Foreign exchange fluctuations also play a role in ARPU variations. The recent surge in ARPU can be attributed to a price hike, coupled with favorable currency exchange movements, which have collectively bolstered Xero's ARPU.

Let’s delve into Net Profit figures to understand how top-line advancements are reflecting in the bottom line. According to the graph, Xero has posted a profit in just two reporting periods to date — the first half of FY2021 and again in the first half of FY2024. Xero has been clear from the start that their strategy is to focus on expanding their subscriber base, investing early on to secure market share. During the first half of FY2021, they curtailed sales and marketing expenditures to assess the impact of COVID-19 on their operations and its potential severity. More recently, a shift in management has steered the company towards prioritizing profitability, as evidenced by the two instances of reported net profit. This demonstrates Xero's capability to turn a profit when they choose to; however, their strategic decision has been to invest earnings back into the company to foster future growth.

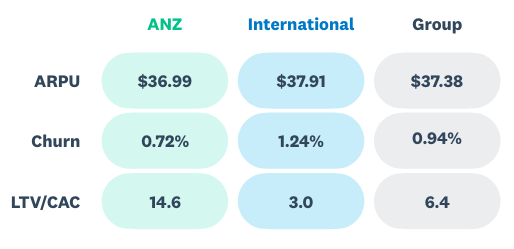

Xero evaluates the return on their investments by employing well-established SaaS metrics, particularly the Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratio. This key ratio is an indicator of the long-term profitability and sustainability of their business model, prioritizing enduring value generation rather than short-term profit gains. Churn rate—a measure of customer retention—is a critical component of this equation for Xero. With an average subscriber lifespan of 8.9 years, Xero’s current figures show a CAC of $581 against an LTV of $3742, resulting in an LTV/CAC ratio of 6.4. This indicates that for every dollar Xero spends on acquiring a customer, they expect to earn $6.4 over the customer’s lifetime with the company. From a financial perspective, an LTV/CAC ratio exceeding 5 is generally considered strong, suggesting that Xero’s investments in customer acquisition are indeed sound.

Exploring subscriber growth across different regions, we observe that while all regions are adding new subscribers, the rate of increase isn’t uniform. Typically, you’d anticipate regions with smaller subscriber bases to exhibit faster growth due to the 'lower base effect'. However, the graph indicates an anomaly to this pattern. The Australia and New Zealand (ANZ) region is expanding even from a larger base of subscribers. Surprisingly, the United States, which starts from a smaller base, is not outpacing ANZ in terms of growth rate. Meanwhile, the United Kingdom is keeping pace with ANZ's growth rate and has now amassed a significant number of subscribers itself.

So you would think that probably, Xero isn’t spending much in acquiring customers in USA but if you look at the figure below than it is apprant that infact Xero is spending good amount of money to capture international market but not as successful in every region - USA in perticular where it has major competition from Intuit and it is evident from the following figures. For ANZ LTV/CAC ratio is 14.6, whereas for International, LTC/CAC ratio is just 3.0

New management’s review of its operations in the US has led to a candid acknowledgment of past missteps, notably an inconsistent strategy that impeded their growth. Historically, their execution varied, but now, they've pinpointed that their product resonates well with small businesses tackling complex tasks and with the Client Advisory Services sector. Learning from past experiences, Xero is shifting gears towards a more concentrated growth strategy, enhancing go-to-market efforts, and refining operational models to be more accountable and responsive within the US market. - We will be able to judge new CEO from FY24 and FY25 results but as it stands, She is speaking the right language and giving right signals. Although LTV/CAC ratio has been improving for international from low 2s to 3. Some of the things I like what has been done in her first 12 months

15% headcount restructure and reshaped org by function - Hired some key positions for well known US companies with good track records

Increased Free Cash Flow in 1H of FY24

Aspiration for future is set to adopt Rule of 40 (Sum of annual Revenue growth percentage and annual Free Cash Flow margin percentage (Free Cash Flow as a percentage of Revenue) calculated on a constant currency basis.) as useful measure while doubling the size of business with more balanced between subscriber growth and ARPU expansion

Although Rule of 40 performance is not guidance nor a prediction of future performance. No timeframe has been set.

Key matrics set to measure success

Outlook

When analyzing Xero's financials, I place particular emphasis on Operating Income.

Xero's business model yields a robust gross profit margin of approximately 87%, which is the percentage of revenue that remains after deducting the Cost of Goods Sold (COGS) from Operating Revenue.

The distribution of this gross profit margin across various operational costs is key to understanding the company’s efficiency. For the fiscal year 2023, Sales & Marketing (S&M) expenses consumed 33.7% of revenues, Product Development (PD) took up another 35%, and General and Administrative (G&A) costs accounted for 12%. Adding these together, the total Operating Expenses represented about 81% of revenues.

Subtracting this from the 87% gross profit margin leaves us with a 6% margin for Operating Income, which is the profit generated from Xero's core business activities before interest, taxes and other one-off.

Looking forward, the management has indicated an intent to reduce these percentages, guiding for total Operating Expenses to be brought down to 75% of revenues for FY24. If they maintain the same gross profit margin of 87%, this reduction in expenses would effectively double the Operating Income margin to 12%. This strategic goal is a clear signal of Xero's focus on optimizing operations and increasing profitability.

Valuation

Xero currently has around 152 million shares outstanding.

For FY24, I'm projecting revenues to reach $1.65 billion, with net profits somewhere in between $190 million and $200 million.

At a share price of ~$120, the market is valuing Xero with a forward Price-to-Earnings (P/E) ratio in the range of 90 to 100. This valuation reflects market expectations for significant future revenue growth and a reduction in operating expenses relative to revenue.

Investors should consider several key questions:

Will the management's renewed investment focus on the US market yield a durable increase in market share?

How will formidable competitors, particularly Intuit in the US and Sage in the UK, impact Xero's market position and growth trajectory?

Is there sufficient growth potential remaining in the ANZ market, or is Xero nearing market saturation in that region?

How quickly can Xero expand its revenue streams? Does it have the capability to successfully branch out into adjacent markets as effectively as it has in its core accounting sector?

To what extent can management streamline operating costs, specifically in Sales and Marketing, without hindering the company’s growth momentum?

These are critical considerations that will determine Xero's ability to maintain its growth and meet market expectations embedded in its current stock valuation. What do you think? I am always open for feedback positive or constructive. Love the engagement. Feel free to put your thoughts in comment below.

Great deep-dive. 2HFY24 didn't disappoint.