ASX:MP1 - Riding the Digital Wave: How Megaport (MP1) Is Changing the Future of Cloud Connectivity"

The Uber of Network Connectivity

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in stocks mentioned and hence probably biased. This website and article isn’t writtent to give you advise. I am just using as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t relie on it. Please conduct your own research or consult a prefessinal financial advisor - I am not the one.

Megaport (MP1) is leading the way in making cloud connectivity much simpler and more flexible, similar to how Uber changed the way we get around. Known as "The Uber of Network Connectivity," Megaport is breaking new ground. This post will explore how Megaport is not just keeping up with digital trends but actually shaping them, offering a future where connecting to the cloud is as easy as ordering a ride.

Introduction

Megaport’s platform uses Software Defined Networking to enable customers to rapidly connect to 398 leading service providers in a flexible, on-demand, and cost-effective way.

In order to align its services closely with cloud compute and storage consumption models, the Group provides a self-serve environment for interconnection. Megaport enables customers to rapidly and flexibly connect to the Ecosystem i.e collection of following

Partner data centres

Cloud service providers

Network service providers

Managed service providers

Customers connect to the Ecosystem by acquiring ‘Megaports’ (‘Ports’) and building Virtual Cross Connects (‘VXCs’) to their chosen destinations or services across the Megaport Network.

Connectivity services can be directly controlled by customers via mobile devices and desktop environments through Megaport’s portal, and its open Application Programming Interface (‘API’).

Megaport Cloud Router (‘MCR’) enables customers to instantly provision and control virtual routers through Megaport’s web-based portal. Enterprises and service providers can unlock powerful use cases such as cloud-to-cloud networking and deploy Virtual Points of Presence (‘vPoPs’) without the need to purchase or maintain physical routing equipment. MCR enables customers to rapidly deploy services, generally contract-free, and reduce their costs of owning and maintaining on-premises infrastructure. Leading cloud service providers advocate MCR as a reference service for enabling connectivity between their cloud solutions and third-party cloud platforms.

Megaport Virtual Edge (‘MVE’) takes our platform beyond data centres and helps enterprises accelerate their journey into Software-Defined approach to Wide Area Networking (‘SD-WAN’) and Secure Access Service Edge (‘SASE’). MVE enables customers to connect branch locations like office buildings, corporate campuses, and satellites to the Megaport ecosystem of service providers. Since its launch in March 2021 Megaport has continued to accelerate the integration of MVE with many of the leading SD-WAN providers to deliver maximum flexibility for our customers.

Megaport sells its services directly to end-user customers and indirectly through or from external partner resellers. One of Megaport’s indirect sales channels, PartnerVantage is aimed at driving revenue and business growth via channel sales. PartnerVantage enables indirect channel partners to sell and provision Megaport services on behalf of their customers, with all the requisite materials, commercial terms and conditions, education and billing information on one platform, to facilitate an easy process for the partners to grow their business.

Megaport is an Alibaba Cloud Technology Partner, AWS Technology Partner, AWS Networking Competency Partner, Cloudflare Network Interconnect Partner, Google Cloud Interconnect Partner, IBM Direct Link Cloud Exchange provider, Microsoft Azure Express Route Partner, Nutanix Direct Connect Partner, Oracle Cloud Partner, OVHcloud Partner, Rackspace RackConnect Partner, Salesforce Express Connect Partner, and SAP PartnerEdge Open Ecosystem Partner.

The Group’s extensive and scalable global footprint across North America, Asia Pacific and Europe offers customers a neutral platform that spans its 812 Enabled Data Centres in key global locations.

Customer Needs and Challenges

This table summarizes the connectivity challenges businesses face today and how Megaport can address them.

Market Opportunity: NaaS Revolution

Network as a service (NaaS) is a cloud-based networking solution that provides businesses with on-demand access to network resources without the need for owning or maintaining physical network infrastructure. It operates on a subscription model, allowing organizations to scale their network capabilities as needed. NaaS offers flexibility, allowing users to manage and customize their networks easily through a centralized platform.

The network as a service market offers simplified solutions for network management by outsourcing tasks like maintenance and upgrades to service providers. This model enhances efficiency and agility, enabling companies to focus on their core operations while ensuring a secure and reliable network environment. NaaS is particularly beneficial for businesses seeking cost-effective, scalable, and easily manageable networking solutions without the burden of extensive in-house infrastructure.

Growth Factors

As businesses undergo digital transformation, there's a growing need for flexible and scalable network solutions. Network as a Service (NaaS) supports the evolving requirements of digital initiatives, such as cloud migration and IoT integration, fostering network as a service market’s growth.

The rise of remote work, accelerated by global events, has increased the demand for NaaS. Companies are seeking reliable and secure network solutions to support a dispersed workforce, driving the adoption of NaaS for remote connectivity and collaboration.

The widespread adoption of cloud services is a significant driver for NaaS. Organizations are increasingly leveraging cloud infrastructure, and with 94% of enterprises in the U.S. implementing cloud services, NaaS is vital for efficient and secure cloud connectivity.

Security is a top priority for businesses, and NaaS providers are incorporating advanced security features. The growing emphasis on cybersecurity and compliance requirements is propelling the adoption of NaaS as a secure and compliant networking solution.

Businesses are drawn to the scalability and cost-efficiency offered by NaaS. The ability to scale network resources based on demand without significant upfront investments appeals to organizations, resulting in increased adoption for optimized resource utilization.

The integration of advanced technologies, particularly Software-Defined Networking (SDN), enhances the capabilities of NaaS. SDN allows for programmable and agile network management, addressing the need for flexibility and efficiency in modern IT infrastructures.

Market size growth

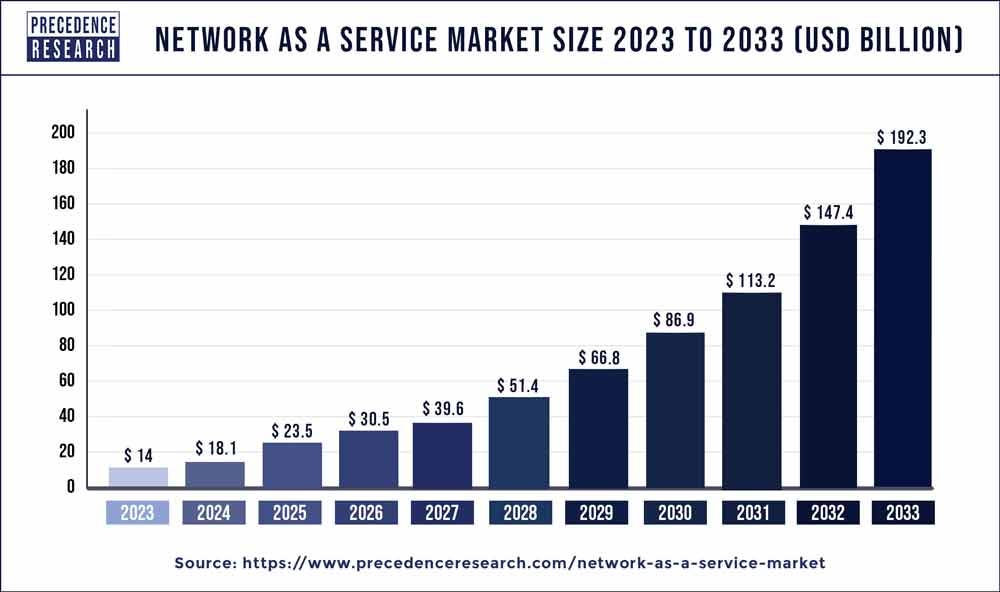

The global network as a service market size reached USD 14 billion in 2023 and is projected to hit around USD 192.3 billion by 2033, growing at a CAGR of 30% from 2024 to 2033.

Megaport Financial performance

Megaport has consistently increased its Annual Recurring Revenue as can be seen in graph below

EBITDA Performance

Net Cash Flow performance

Operating Leverage december month

Borrowing

As of the end of December 2023, The total borrowing for Megaport stands at $12,490,000. This is segmented into 'current' and 'non-current' borrowings, with the former sitting at $7,256,000 and the latter at $5,234,000.

It's worth noting that these borrowings are part of vendor financing agreements that are interest-free and repaid in equal installments over three years from the initial drawdown date.

Valuation

Megaport has an issued share base of approximately 160 million ordinary shares. The company's liquidity position is strong, with total cash in hand amounting to $63 million. For the FY2024, Megaport has given outlook for solid financial performance, with revenue reaching $190 - 195 million range and EBITDA is expected in the range of $51m to $57m.

Looking forward to FY2027, If we assume that Megaport increases its revenue around $380 million, achieving a gross profit of $266 million and a net profit of $135 million.

Applying a price-to-earnings multiple of 30 times the net earnings in FY27—a standard valuation metric for companies within the same industry exhibiting comparable growth trajectories—gives us a projected market capitalization of $4.1 billion for Megaport. Assuming the number of ordinary shares increases modestly to approximately 170 million, the calculated future share price is approximately $24.05.

To reconcile this future valuation with present value terms, we discount it by 10% to account for the risk and time value of money, arriving at a present value of $17.54 per share for FY24. This discounted valuation method provides a current investment perspective that incorporates anticipated financial growth while adjusting for future uncertainties and the cost of capital.

In summing up valuation, it's important to remember that while the formula we use to calculate valuation may seem straightforward, the real challenge lies in the assumptions we make. Small changes in these assumptions can lead to significant differences in our valuation outcomes, making precise forecasting a complex task. Therefore, constant vigilance and monitoring of the company's performance and market conditions are essential. I will continue to provide updates and insights as new information becomes available.

If its so good why Bevan is selling his shares?