PWR Holdings (ASX:PWH): Business Overview

My thoughts on current development

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in the stocks mentioned and hence probably biased. This website and article aren’t written to give you advice. I am just using it as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t rely on it. Please conduct your own research or consult a professional financial advisor - I am not the one.

Business Overview

PWH employs around 550 people and operates roughly 30,000 m² of factory space equipped with specialised plant and equipment across Australia, the UK, and the USA.

The company designs, manufactures, and supplies advanced cooling systems for niche, high-performance applications. Its four key end-markets are:

Motorsports (Formula 1, NASCAR, WRC, Supercars, etc.)

OEMs building special-edition vehicles

Aftermarket performance parts

Aerospace & Defence

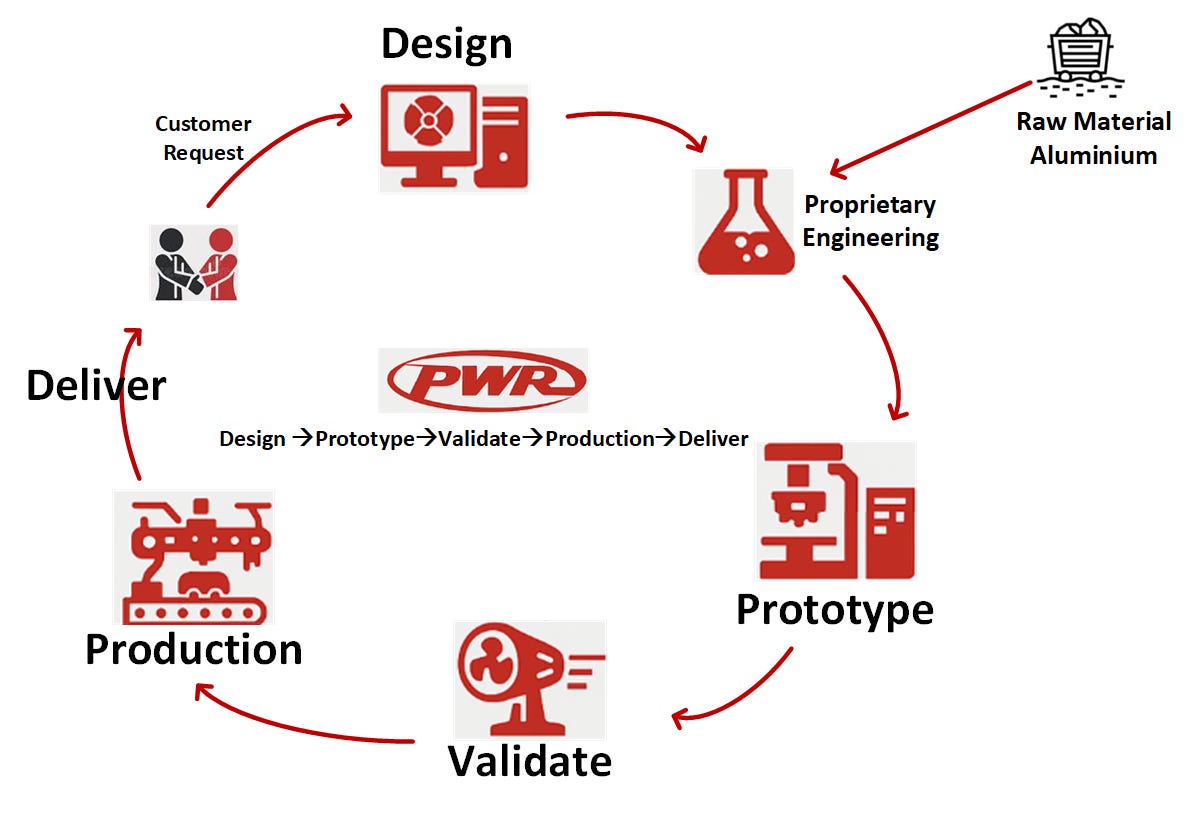

The following drawing shows the business model of PWH

Today, Motorsports contributes a little over half of group's revenue. OEM and Aftermarket together account for roughly one quarter, while Aerospace & Defence has climbed to about a quarter, up from almost nothing just a few years ago. (These splits come from the 1H FY25 result; OEM and Aftermarket were softer than usual, so mix may shift again, but the broad picture of where PWH earns its money still holds.)

PWH secret sauce

PWH excels in a niche where precision and performance matter far more than cost. Customers care about every gram of weight and every millimetre of space; “good enough” off-the-shelf parts simply won’t do. Instead, they need a partner that can take raw aluminium in one door and deliver a fully-engineered, validated, custom cooling solution out the other—quickly and reliably.

Mass-market automakers struggle to match this because their margins depend on scale, stable designs, and relentless cost control, not annual redesigns for peak performance.

Tiny fabricators can’t keep up with PWH’s continual R&D spend, IP portfolio, and deep relationships with top-tier racing teams, OEM engineers, and aerospace primes.

That dynamic leaves PWH sitting comfortably between the giants and the minnows, protected by three main barriers to entry:

Together, these defences make it tough for newcomers to dislodge PWH or replicate its vertically integrated, high-performance model.

Total Addressable Market (TAM)

PWH operates across four segments: Motorsports, OEM, Aftermarket Spare Parts, and Aerospace & Defence.

Motorsports is its bread and butter. PWH supplies cooling systems to a wide range of racing teams across multiple global competitions, including Formula 1, where it claims to supply every single team. As motorsports continues to grow in global popularity and commercial success, team budgets are expanding, especially in areas like R&D for high-performance components. A portion of that increased investment flows to suppliers like PWH.

That said, motorsport isn’t a TAM monster. Based on various research papers I’ve come across, the motorsport market is expected to grow at a low single-digit CAGR between 2024 and 2030. So while it won’t see explosive growth, motorsport serves a more strategic purpose for PWH.

it’s an engineering showcase and testing ground. This helps PWH maintain its technical edge and lends credibility as it expands into adjacent, higher-growth segments like Aerospace & Defence.

Similarly, the OEM and Aftermarket Spare Parts markets aren't expected to deliver huge TAM expansion either. But all three of these divisions i.e, Motorsports, OEM, and Aftermarket, are:

High-margin

Cash-flow generative

R&D transferable to other applications

And contribute to brand credibility across industries

The real opportunity lies in Aerospace & Defence. PWH has grown this segment organically, leveraging its core R&D and engineering capabilities. From almost nothing five years ago, it now accounts for roughly 22% of total revenue.

This growth demonstrates that PWH is beginning to establish itself in a sector that values technical performance, customisation, and reliability, traits that align well with PWH’s DNA. If the bets it is currently placing in this segment continue to play out, Aerospace & Defence could become a breakout growth engine for the company in the years to come.

Recent setbacks

PWH’s share price has taken a hit following a decline in revenue during 1H FY25, which broke the company’s usual pattern of consistent growth. Management attributed the drop to the completion of two major OEM programs, as well as three niche OEM EV programs that did not proceed in FY25, despite having issued purchase orders in FY24.

Understandably, management noted that cost structures couldn’t be adjusted quickly enough to match the lower-than-expected volumes, which affected margins.

All of this has come at a time when PWH is in the midst of its largest investment phase to date. It has expanded factory capacity in both the UK and the US, and signed a lease for a new facility in Australia that’s twice the size of the current one. The company has guided that the transition to the new Australian facility will complete by November 2025, but also cautioned investors about the potential for production delay. I think it’s a fair warning, as such complex moves rarely go perfectly to plan.

Another challenge emerged in April, when founder and CEO Mr Kees Weel took medical leave. In his absence, Mathew Bryson has been appointed Acting CEO.

There’s no doubt this is a challenging period for the company. And while it's not a reflection of management’s competence, the reality is that things rarely go exactly to plan in the short term, especially during large transitions like facility moves and leadership changes. So yes, there are some risks of missteps along the way, even if the long-term direction remains sound

Potential Catalysts in future

During the 1H FY25 results, Management indicated that they have reviewed the organisation structure, headcount, and annual sale price increase, and the full impact of these measures hasn’t been reflected in the 1H financial results.

Formula 1 regulation changes are expected to drive revenue growth in H2 FY25. One more team added to F1, potentially increasing motorsport revenue by 10%

Aerospace and Defence segment will see high demand based on macro ( as it is market is expanding )

Short position has increased to 7.22% ( i.e, roughly 7.2m shares).T hat’s a significant number of shares already sold that, at some point, will need to be bought back. It can potentially add buying pressure if sentiment shifts or the company delivers better-than-expected results in August.

Valuation

So there is potential for me to create a bear case based on all the setbacks or create a bull case based on all the potential catalysts that I pointed out earlier. Well, PWH is a profitable and cashflow-generating company with negligible debt, so there is a floor to the downside, but if this is going to be a temporary issue, then upside can be significant in the future.

Currently, PWH is trading roughly at $660m market cap. So if I put that straight into a term deposit, I can get 33m every year at a 5% interest rate. Based on my calculation in FY24 it generated roughly $17.5m in free cashflow so based on current price 2.5% yield ( Although FY25 is going to be transition year and won’t generate same amount ) so if you look at 5 years down the track and assume that it increase its free cashflow by 15% then it will match 5% yield of term deposit but from there on it can grow its future cashflow significantly. ( Mind you, this is a very crude way to see the value as I haven’t factored in a lot of other things, but this gives me a rough idea)

So obviously market cap of the company has come significantly lower than what it used to trade, but still, at the current market cap, there are lofty expectations backed in. It would be interesting to see how things pan out, but I am looking forward to FY25 results.

Only thing I would add is that the new F1 cars for 2026 season will be a big spike too, they will all need totally new and redesigned cooling systems as they are such different drive trains. (more EV, less ICE.)

I happily took a large position on what I believe is a serious misjudgement by Mr Market of the intrinsic value of this business. It had been on my watchlist for years, it requires patience to get a position in the great businesses at any sort of discount to value.

Nice write up. Thanks for sharing