Nanosonics (ASX:NAN) FY25 result analysis

What matters next?

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in the stocks mentioned and hence probably biased. This website and article aren’t written to give you advice. I am just using it as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t rely on it. Please conduct your own research or consult a professional financial advisor - I am not the one.

I first covered Nanosonics in April 2024, where I did a deep dive on the business model. You can read it here.

I also wrote my views after the FY24 result, which you can read here.

Below are the highlights from Nanosonics’ FY25 results:

Revenue rose 17% to $198.6 million

NPAT increased 59% to $20.6 million

Free cash flow was up 52% to $32 million

Cash and cash equivalents of $161 million on the balance sheet, no debt

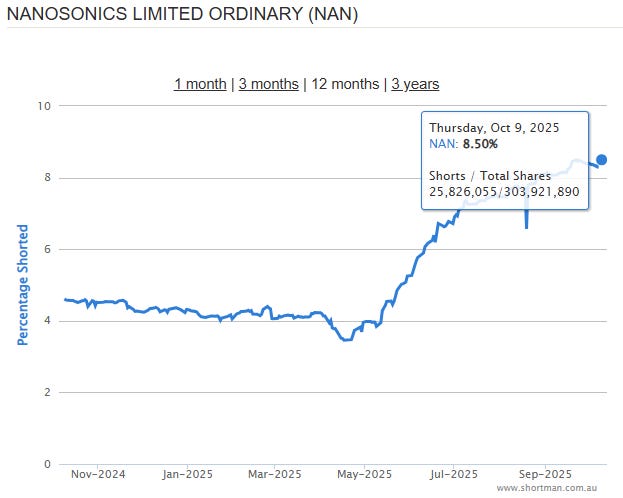

Those numbers look impressive. That said, short interest is currently elevated: at the time of writing, roughly 8.5% of the company’s shares (~25.8 million) are sold short.

So naturally, it’s important to understand the bear thesis. First, I’ll lay out the FY25 operational and financial performance. Then I’ll dig into what the bear case could be, my thoughts on it, and the key signs I’ll watch for in the future.

Operational performance

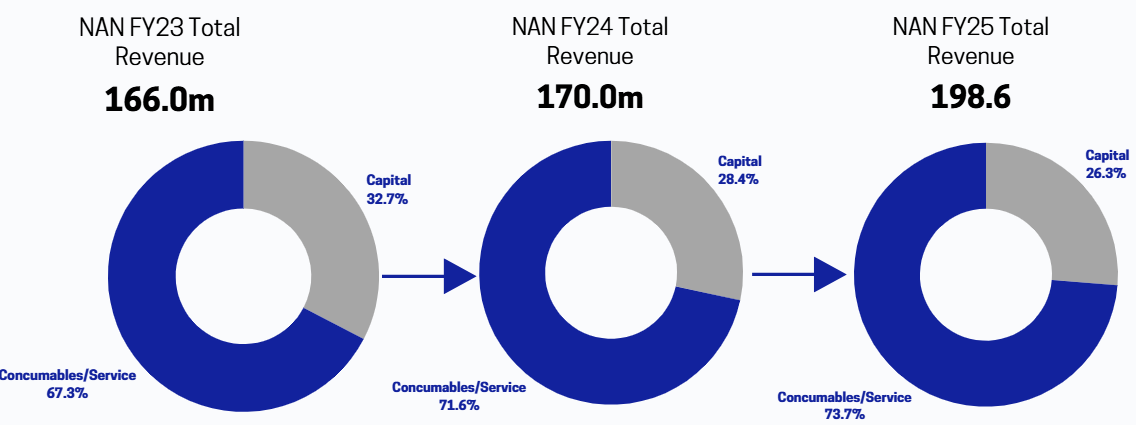

As I mentioned in my earlier post, Nanosonics generates revenue primarily from selling its Trophon2 device, either to new customers or by upgrading the older Trophon EPR devices for existing customers. However, their recurring revenue come from the high-margin consumables and service revenues tied to their growing installed base.

Following the close of FY25, Nanosonics released its next-generation trophon3. trophon3 delivers ~40% faster cycles than the previous generation, with expanded digital integration and broader traceability. Customers with first-generation EPR devices can upgrade directly to trophon3; there are roughly 10,000 such units in the field. Customers with trophon2 can upgrade to trophon3 via a software upgrade rather than buying new hardware; there are roughly 20,000 trophon2 devices that could take this upgrade. Alongside trophon3, Nanosonics introduced a SaaS-style connectivity subscription that provides digital traceability via customers’ DICOM imaging systems.

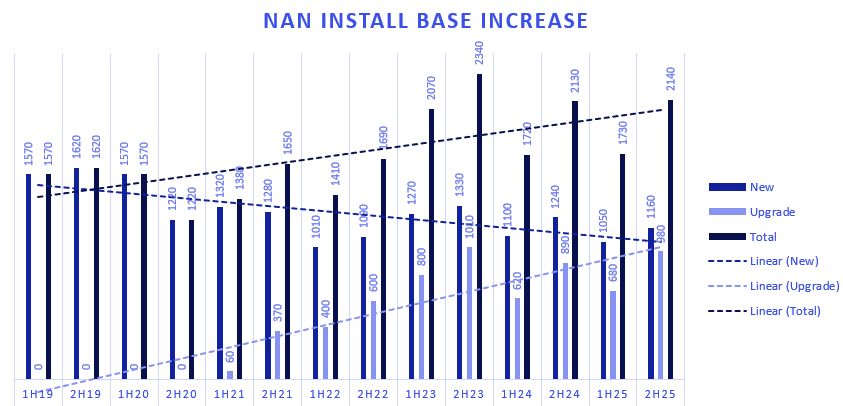

The chart below shows half-on-half additions from new installs and upgrades. The rate of new installs is slightly decreasing, but that’s being offset by a rising upgrade contribution.

As the installed base grows, Nanosonics’ revenue mix continues to shift toward high-margin consumables and service (you can see this transition in the chart below)

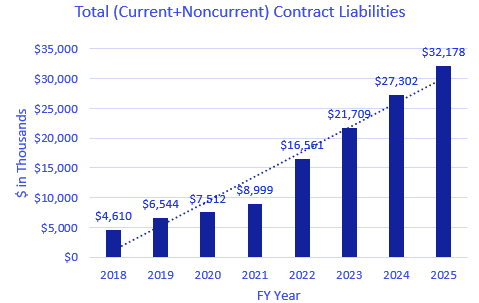

As noted in my earlier piece, Nanosonics shifted to a direct sales model in North America, transitioning customers from GE to direct. Most customers opt for multi-year service agreements, often paying upfront. Those upfront payments appear on the balance sheet as contract liabilities, which have been expanding (see chart)

On top of service, the new SaaS connectivity subscriptions become an additional revenue layer attached to both new installs and upgrades going forward.

Financial Performance

Revenue

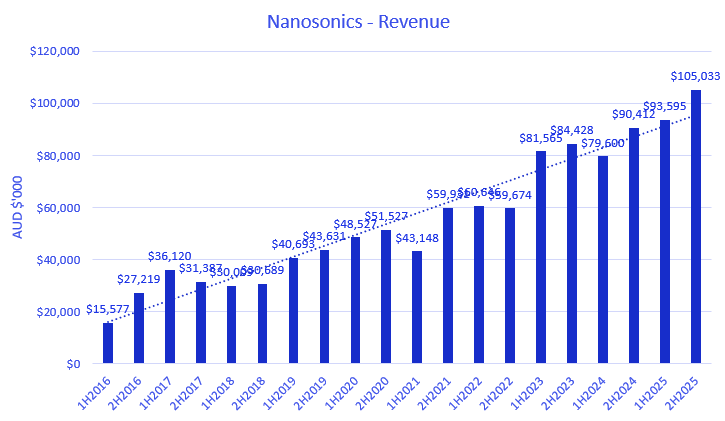

Nanosonics has variable growth may be some year bit less and some year bit more but if you look at the long term record, don’t think anyone can fault the performance at all.

Gross margin

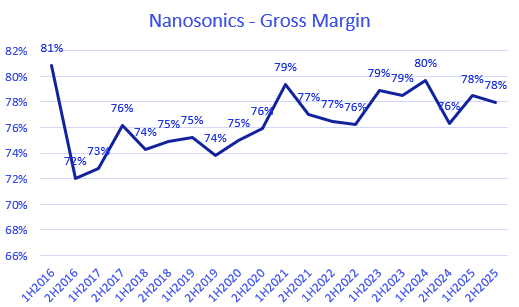

As indicated earlier, nanosonics revenue includes high margin (almost SaaS like) consumable+service revenue and capital revenue which is slightly less gross margin and at company level it operates in the range of high 70s for gross margin as can be seen in the graph below.

R&D

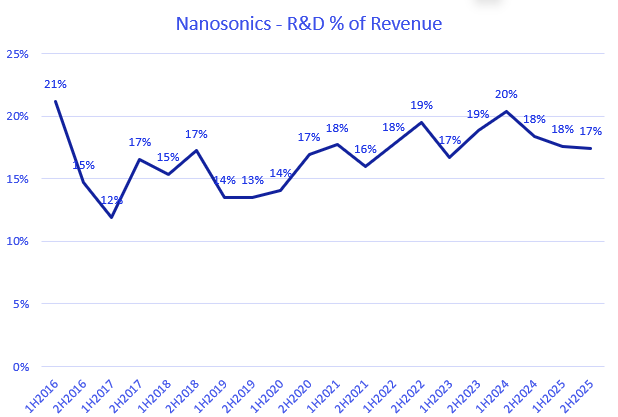

Out of that ~78% gross margin, Nanosonics still invests heavily in R&D—roughly 17–20% of revenue. Most of this has gone into CORIS. The company is currently commercialising CORIS, and I expect revenue contribution from FY27 onwards. Because Nanosonics expenses R&D, reported profit looks lower than the profit core business generates. The chart shows R&D as a percentage of revenue; I’d expect this ratio to trend down in the medium term.

Net Margin

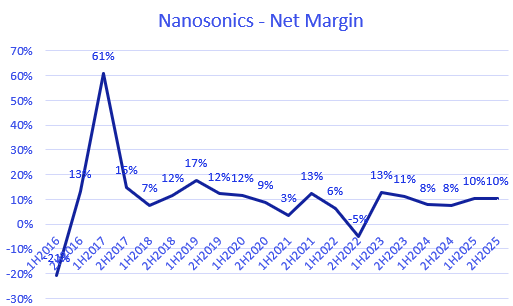

Even with elevated growth investment, Nanosonics is still delivering a ~10% net margin, as shown in the chart.

Balance Sheet

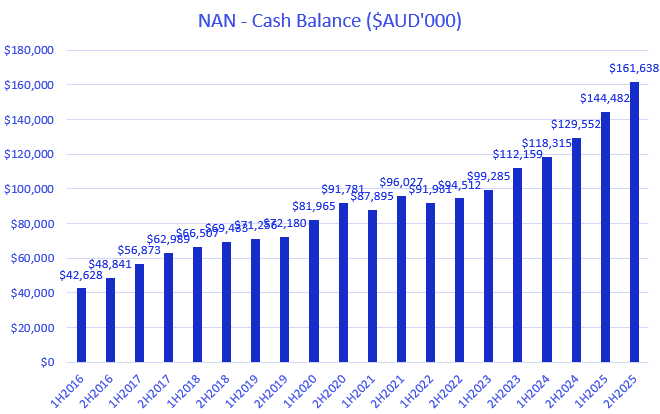

No issues here. No debt and about $161 million in cash and equivalents puts the company in a strong financial position.

What are Bear cases?

Let’s keep valuation aside for now (I’ll cover it later). The core business has performed well, so the bear view is essentially that the future won’t look like the past. Here are the main cases I think bears have in mind.

Case 1: Trophon is highly penetrated, with limited installed-base growth

There’s some truth here. Trophon has captured more than 50% of the North American market. That said, there’s still roughly 27,000 units of TAM in North America (about two-thirds in hospitals and one-third in private practices), plus a significant international opportunity. Yes, the number of boxes they can sell has an upper limit, but Trophon3 creates an upgrade cycle, and consumables/service revenue should keep growing with ultrasound procedure volumes. On top of that, connectivity SaaS is a new attach revenue stream. In short, management still has several growth levers. ( Its more important to see how much revenue they can generate from torphon business going forward compare to how much boxes they sell)

Case 2: Competition will eat share

As I noted earlier, Germitec received FDA De Novo clearance last year, and Tristel ULT (ClO₂ foam) is FDA-cleared and promises point-of-care HLD with no machine capex—appealing to cost-sensitive, space-constrained sites (see: https://www.accessdata.fda.gov/cdrh_docs/pdf22/DEN220041.pdf). Competition exists in every good market. The trophon moat isn’t just the machine; it’s the validated protocol, training, audits, and service relationships. Replacing an entrenched workflow in a highly regulated hospital environment is slow and costly.

Case 3: CORIS adoption will disappoint (plumbing, long sales cycles)

Endoscopy is not like ultrasound. Ultrasound probes are cleaned in the room with the patient, so plug-and-play devices work there. Flexible endoscopes are sent to a central reprocessing room with plumbing, AERs, drying cabinets, and a strict dirty-to-clean layout. CORIS is designed for that room. Practically, this means a hospital may need fewer CORIS devices than trophon units (CORIS is a shared room asset). So the capital opportunity is smaller, but the consumable/service/connectivity (recurring) opportunity is much larger than trophon. And yes, sales cycles will be longer—hospitals run trials, check infection-control policy, and seek multiple approvals. The payoff is a larger recurring layer if adoption lands.

Case 4: R&D and capital allocation skepticism

Bears argue the payback on years of R&D is unproven without visible CORIS uptake, and that management is sitting on a ton of cash. It’s fair to say CORIS took longer than I expected and had multiple delays, but we’re now close to the commercial phase. Management has flagged that once CORIS is in market, cash can be put to work in M&A to build out adjacent steps in the endoscope workflow. CORIS solves one problem; there are adjacent workflow targets Nanosonics can pursue.

Valuation

A common bear line is: “It trades on a ~65× P/E. Its too expensive.”

My view: trophon alone is a highly profitable cash business with a strong moat (standard of care; >50% share). Recent trophon-only profit before tax (PBT):

FY22: $16m

FY23: $44m

FY24: $41m

FY25: $52.8m

It isn’t rocket science to say the trophon business is a strong cash machine, growing earnings at >30% CAGR over the last four years. If we assume 15% earnings growth for the next three years (10–12% revenue growth plus operating leverage), that implies ~$80m PBT in FY28, or ~$56m NPAT. On a 40× P/E for this trophon-only business, the implied FY28 share price is ~$7.34; discounting back gives ~$5.35 today. (Again, this is for trophon only.)

In the best case, if CORIS is even mildly successful, the valuation would be higher. If CORIS underwhelms, trophon still sets a floor. The simple takeaway: despite a seemingly high headline P/E, a deeper look suggests the stock may not be as expensive as it appears, and the market may be giving little credit to CORIS at this stage.

Changes

Short-term incentives (STI) changes

They will judge short-term performance on EBIT instead of Profit before tax. ( I think it is good that management don’t get incentivised on interest income on sizable cash that they are holding. I am hoping this doesn’t incentivise them to go for acquisition for its sake)

Focus is also shifting from Total units to annuity revenue growth. Management will be rewarded on growth in recurring revenue instead of device units. ( I don’t know what this indicate, does it indicate that device revenue growth isn’t coming anymore or recurring revenue will grow faster going forward- will see)

Long-term incentives (LTI) changes

Couple of years back I didn’t like it when they changed incentives from company-wide EPS to Trophon only business PBT. This year they have made a switch. focus is back to company-wide EPS CAGR ( this definetly signals that R&D will go down as % of revenue and CORIS will start contributing in medium term)

Headquarter Relocation

Nanosonic current HQ lease expires on 31 March 2027 and it has signed new contract for new premises. New lease will commence on 1st April 2027 but Nanosonics will gain early access to these facilities from 1 April 2026, so expect increased capex for fit out and relocation cost etc.

Final thoughts

Obviously, Nanosonics has performed well in the past, but the future is what matters in investing. As outlined earlier, there are multiple cases the bears can point to; however, none of them are set in stone or prove things must go downhill from here. I’m optimistic at this stage. I think the company has a competitive moat, pricing power, and multiple levers for growth in the coming years. I also acknowledge there are risks, and I’ll keep my eyes and mind open to spot them early