Megaport (ASX:MP1) 1H FY25: Early Signs of a Turnaround?

Can Megaport Keep the Momentum?

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in the stocks mentioned and hence probably biased. This website and article aren’t written to give you advice. I am just using it as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t rely on it. Please conduct your own research or consult a professional financial advisor - I am not the one.

Back in August 2024, when I analysed Megaport’s FY24 results and FY25 guidance, I ended with a key question: - you can read it here

Can Megaport successfully Reverse the Decline in Net Revenue Retention?

Again, when I wrote back in November 2024 after it’s AGM ( here )- I broke down drivers behind NRR story for Megaport and ended up with following conclusion

Is Management on the Right Track? Yes, their strategy seems sound. Now, the challenge lies in execution. Only time will tell if Megaport can overcome its NRR headwinds and deliver on its growth potential. For now, I should monitor progress closely while remaining patient.

It’s no surprise that I was watching NRR closely in the 1H FY25 results. When Megaport reported in February, the good news was that management highlighted NRR right on the front page of the presentation — pointing to the first signs of stabilisation.

The Good News: NRR Is Stabilising

Megaport reported a Net Revenue Retention (NRR) of 107%, meaning revenue from existing customers grew by 7% over the past year. That’s after accounting for customer expansion (like upgrades, increased usage, and add-ons) and subtracting churn (downgrades, reduced usage, or cancellations).

Historically, 60–70% of Megaport’s growth has come from existing customers. While this result hasn’t quite reached those levels, it’s a step in the right direction. NRR has improved by 1 percentage point from the previous half, and the early signs suggest further improvement may be coming.

In my earlier article, I broke down the key factors that influence NRR — and encouragingly, many of them now seem to be trending in the right direction:

Market conditions are improving –Global NaaS peers have recently reported stronger NRR, suggesting a healthier environment for the sector. That said, there are some potential headwinds on the horizon. With Trump’s tariff announcements and rising tensions between the world’s two largest economies, there’s a risk of a broader trade war. While this may not directly impact Megaport, no company operates in isolation — effects on suppliers, customers, or the broader supply chain could still have indirect consequences.

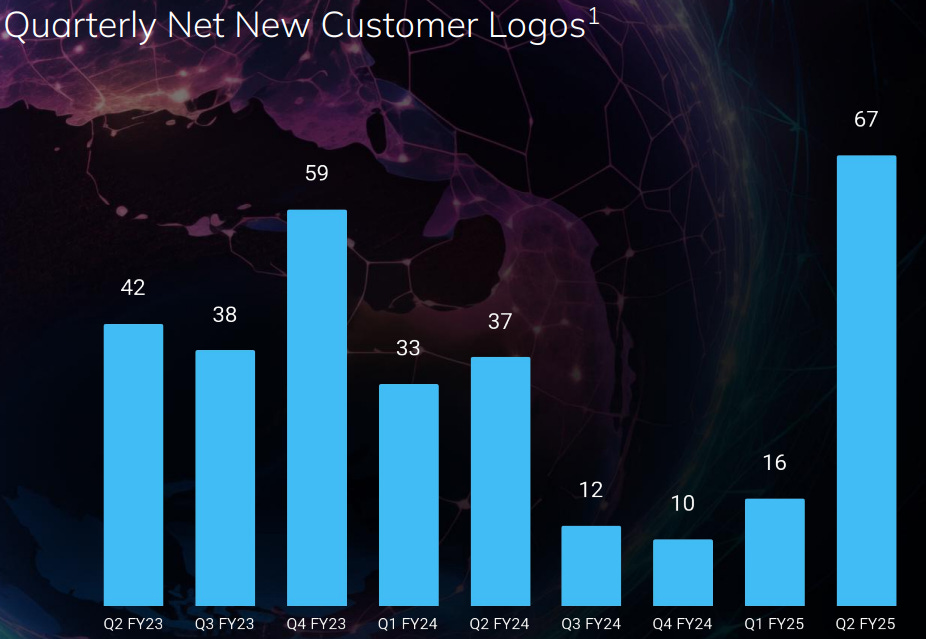

New customers tend to expand faster – Megaport's presentation shows a clear uptick in new customer acquisition, along with growing momentum in its access products — typically the first step customers take to connect to the Megaport fabric. (Screenshots below.)

New product offerings – Megaport has launched new products aimed at driving more usage from existing customers.

Go-to-market investment – Megaport has been investing in GTM efforts, including its customer success team, which should help with both expansion and retention.

Small Greenshoots, Cautious Optimism

It’s not just about NRR. Management also tightened the lower end of revenue guidance while maintaining EBITDA guidance, even after absorbing a $4 million opportunistic go-to-market (GTM) investment.

This suggests a balanced approach: investing for growth, while keeping profitability intact.

Personally, I’ve moved from being doubtfully optimistic to cautiously optimistic. I remain a fan of the structural tailwinds supporting Megaport’s business model — and this result gives me more reason to watch closely.

Let’s Break Down the Numbers

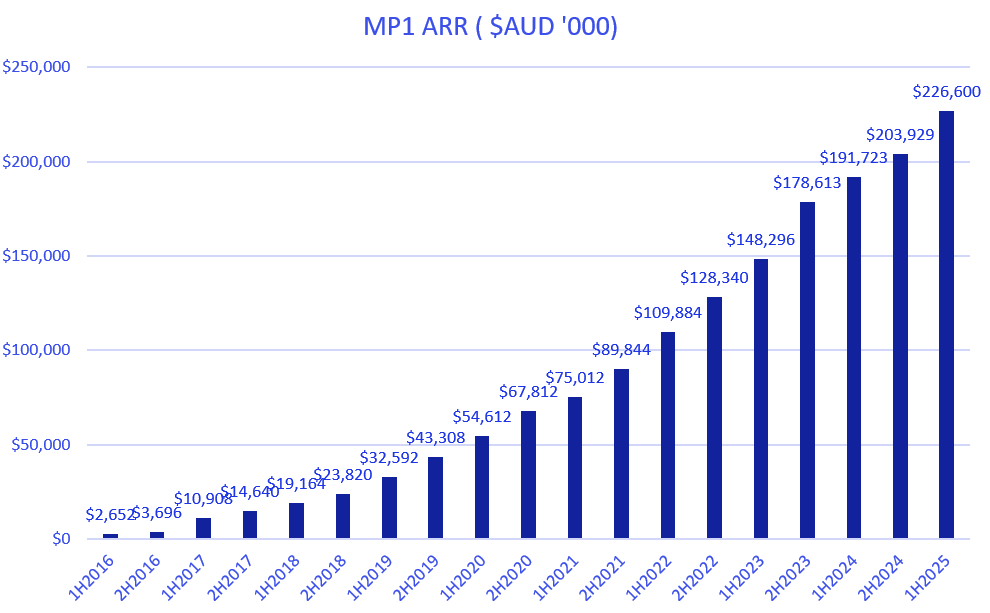

Annual Recurring Revenue (ARR)

One of the key metrics for Megaport is Annual Recurring Revenue (ARR), which is calculated by multiplying the Monthly Recurring Revenue for the last month of the period by 12

last time when i analysed FY24 result, i said the main problem is the slowing growth of ARR growth. This half, I am seeing improvement ( Although during 1HFY25 there is considerable currency tailwind, even if we compare constant currency - ARR growth is 14%, which is better than my expectation based on my last post). Here’s a look at the growth of ARR growth pattern:

and if you want to see ARR growth pattern, following graph shows it

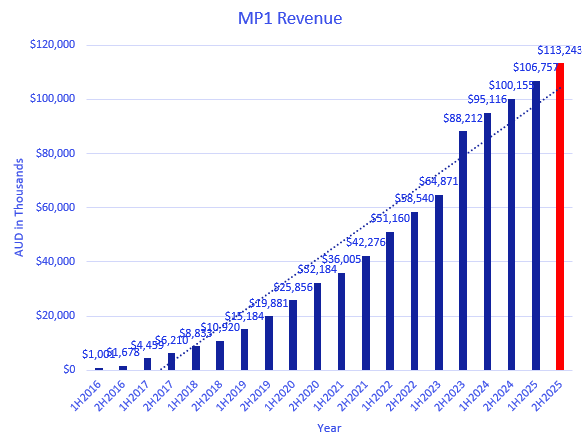

Revenue

Revenue flows directly from ARR (Note: the 2H FY25 estimate in red is my projection.)

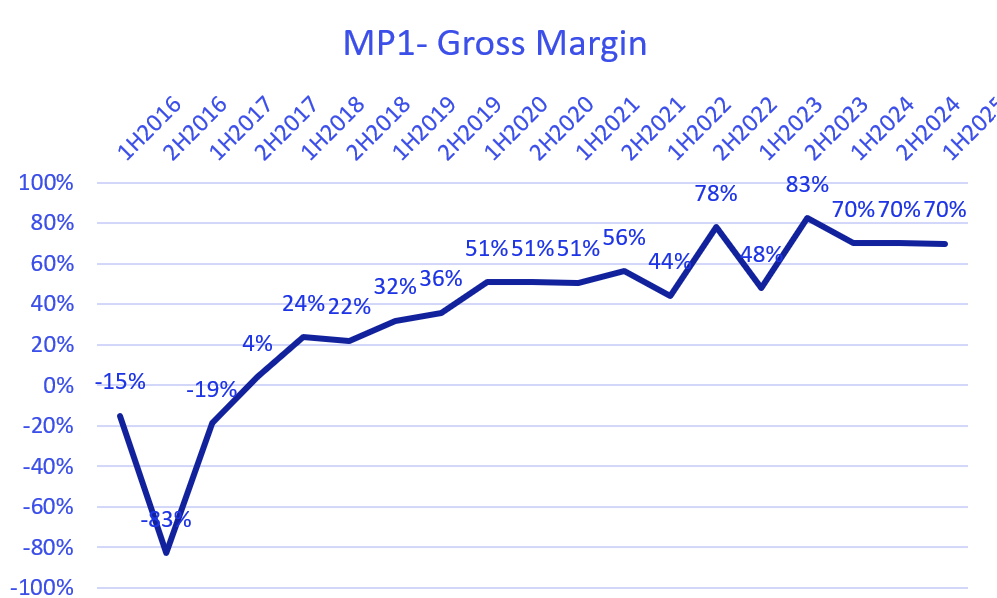

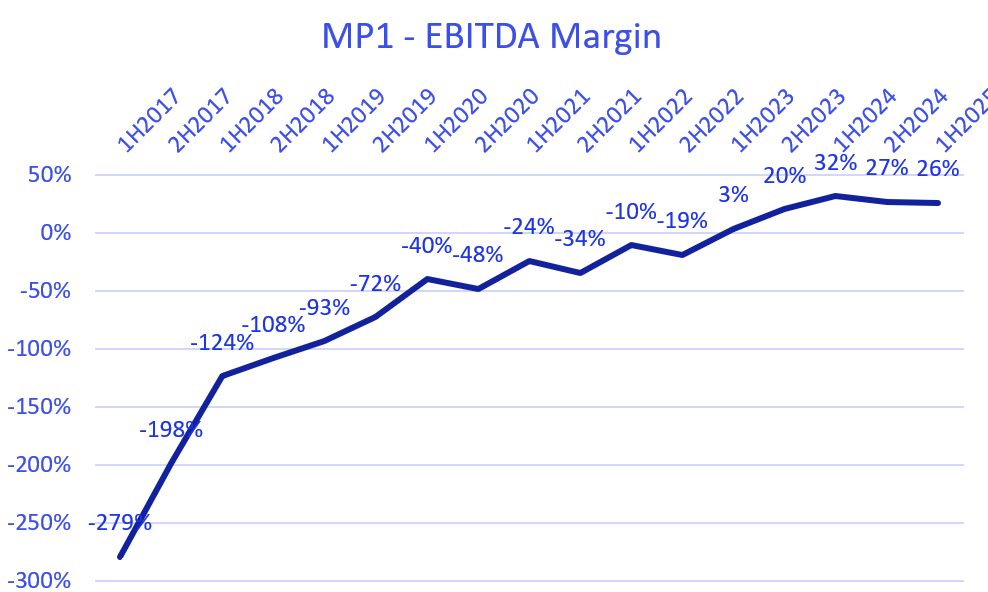

Margin Trends: Gross, EBITDA, and Net

It’s clear Megaport has pivoted hard toward profitable growth, as the market demanded.

The business model is proving to be sustainable, and I believe we’ve yet to see the full benefits of operating leverage kick in.

The following three charts show margin trends, which tell an important part of the story.

My thoughts

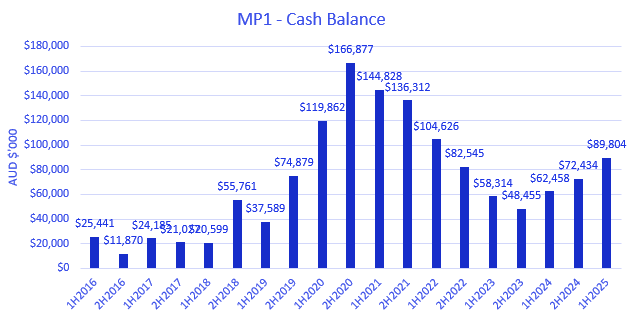

In its early years, Megaport benefited from a “growth at all costs” environment, scaling rapidly but burning a lot of cash until FY22.

Since then, the company has pivoted successfully toward profitability, responding well to market pressure. Now, it appears to be finding a middle ground — investing to grow ARR while remaining just above the profitability line. It doesn’t seem to be optimising for maximum net or EBITDA margins just yet — and that’s okay.

The industry tailwinds remain strong, and the 1H FY25 result shows early greenshoots. Execution momentum will be key going forward.

From a macro perspective, there are some mixed signals:

Trade tensions could lead to higher equipment costs in the U.S., potential supply chain disruptions, and a general dampening of business sentiment. On the flip side, they could also raise barriers to entry — which might work in Megaport’s favour by limiting new competition.

The weak Australian dollar is currently a tailwind for Megaport, but that could easily reverse. Rather than stressing over things outside the company’s control, I prefer to focus on how well it's executing its strategy.

In any case, the macro environment is shifting so rapidly that it's impossible to predict what’s next. The good news? Megaport is building its cash balance and has a strong balance sheet, and I believe it’s well-positioned to absorb shocks and emerge stronger on the other side.

And based on this result, I see a little more hope for the future.